claim workers comp taxes

It doesnt matter if theyre receiving benefits for a slip and fall accident muscle strain back injury. If your disability pension is paid under a statute that provides benefits only to employees with service-connected disabilities part of it may be workers compensation.

Is Workers Comp Taxable Do You Have To File Workers Compensation Income On Tax Returns Are Workmans Compensation Settlements Taxable

Unfortunately even tax preparers can get this wrong advising their clients to claim their.

. Thats because most people who receive Social Security and workers comp benefits dont make enough to owe federal taxes. Income from the WCB will be reported in Box 10 of the T5007 slip. Most workers compensation benefits are not taxable at the state or federal levels.

Report the amount on line 14400 of your Income Tax and Benefit Return to calculate your eligibility for any. The lone exception arises when an individual also receives disability benefits. Compensation paid by OWCP is not subject to income tax.

Usually the amount ranges. Workers compensation benefits are not normally considered taxable income at the state or federal level. No you usually do not need to claim workers comp on your taxes.

Thats because the IRS considers workmans compensation paid under a workers compensation act or statute of a similar nature as fully tax-exempt. Workers Compensation Benefits Are Not Taxable. The question gets raised often because many injured.

Tax Liability from Combined Disability Income. However a portion of your workers comp benefits may be taxed if you also receive Social. Workers Comp is Generally Not Taxable.

That part is exempt. With tax reform in the headlines you may be asking whether you need to pay taxes on workers comp benefits. The following payments are not taxable.

Go back to sleep because you do not owe taxes on workers compensation benefits in Minnesota or federally. Whether you have received weekly payments or a lump. Workers compensation benefits and settlements are fully tax-exempt which means you do not have to pay taxes.

Should I claim workers comp benefits on my taxes. So even if part of their benefits is taxable its. From IRSs Publication 525.

Tax Liability for Lump-Sum Settlements. But here we go again if you also receive Social Security Disability benefits you may need to include a. According to the IRS the answer is no.

Under most normal circumstances workers compensation payments are tax-free income for disabled individuals who are unable to work on a temporary or permanent basis. Although workers compensation is not taxable you are still required to file a return if the income you earned in addition to your workers compensation meets the IRS filing requirements. If your tax adviser.

On This Page. According to the IRS you do not have to pay income taxes on benefits paid under workers compensation. The quick answer is that generally workers compensation benefits are not taxable.

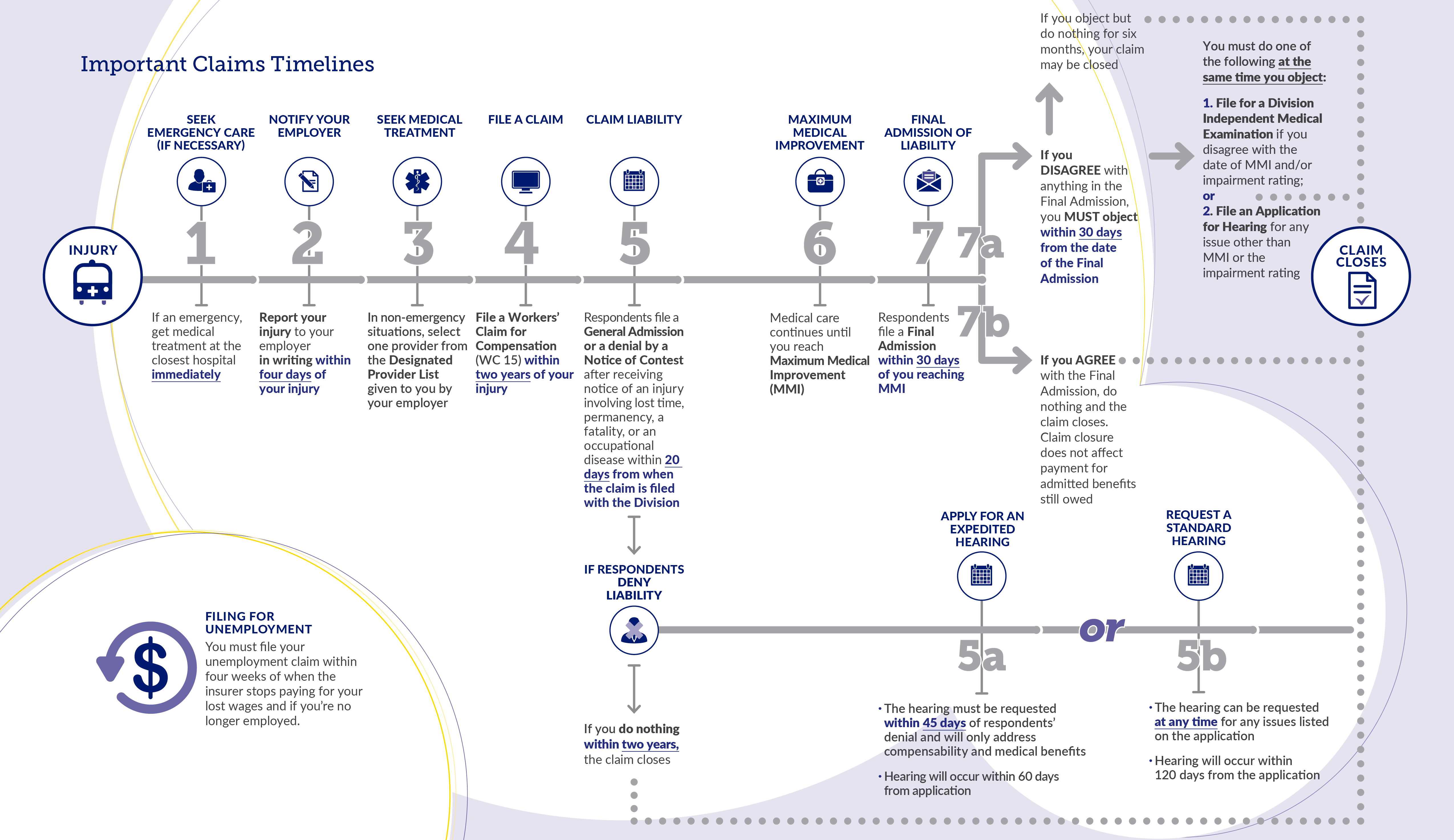

Workers compensation is generally not taxable and is not earned income so it would not qualify you for EITC. IRS Publication 907 reads as follows. If the disability is expected to continue beyond the period claimed on the initial CA-7 the employee should.

Workers compensation for an occupational sickness or injury if paid under a workers compensation act. In fact as far as the IRS is concerned workers comp falls into the same non-taxable category as welfare payments economic damages awarded in a personal injury case please note that. And those who dont yet receive workers comp may wonder if theyll owe the.

Do I Have To Pay Taxes On My Workers Comp Benefits

Is Workers Compensation Taxable In North Carolina Riddle Brantley

Workers Compensation And Taxes James Scott Farrin

Is Workers Comp Taxable In Nj Craig Altman

Do I Have To Pay Taxes On A Workers Compensation Settlement Workers Compensation Lawyers Ben Crump

Paying Taxes On Workers Compensation In Florida Johnson Gilbert P A

Is Workers Comp Taxable What To Know For 2022

When Does Workers Comp Start Paying Benefits Or When They Should

Is Workers Comp Taxable Gordon Gordon Law Firm

Is Workers Compensation Taxable Klezmer Maudlin Pc

How To Deduct Workers Compensation From Federal Tax Form 1040

Do I Have To Pay Taxes On A Workers Comp Payout Adam S Kutner Injury Attorneys

Is Workers Compensation Taxable Klezmer Maudlin Pc

File A Workers Compensation Claim Department Of Labor Employment

Will My Workers Comp Benefits Be Taxed In California

Do I Pay Taxes On My Workers Compensation Settlement In Ohio

Is Workers Comp Taxable Workers Comp Taxes